douglas county nebraska car sales tax

The Colorado Department of Revenue now has an online Sales Tax Rate Locator for your use. Douglas County CO Sales Tax Rate The current total local sales tax rate in Douglas County CO is 4400.

/cloudfront-us-east-1.images.arcpublishing.com/gray/QJNBDO36B5K6JBWFVEM56S5IOU.jpg)

Douglas County Treasurer Reorganizing Service Locations

The cost to register your car in the state of NE is 15.

. 50 - Emergency Medical System Operation Fund - this fee is collected for Health and Human Services. The Nebraska sales tax on cars is 5. The 2018 United States Supreme Court decision in South Dakota v.

The current total local sales tax rate in Douglas. 1 2022 The Town of Castle Rock and the Town of Larkspur were. As far as other cities towns and locations go the place with the highest sales tax rate is Elkhorn and the place with the lowest sales tax rate is Bennington.

Real Property Tax Search Please enter either Address info or a Parcel Number. The December 2020 total local sales tax rate was also 5500. The County sales tax rate is.

After identifying your location use the Export function to download a PDF for proof of sales tax rates that you may download or print. This example vehicle is a passenger truck registered in Omaha purchased for 33585. TAX DAY NOW MAY 17th - There are -374 days left until taxes are due.

Start filing your tax return now. Copy of current VIN-specific proof of insurance. Douglas County NE currently has 9530 tax liens available as of May 14.

The one with the highest sales tax rate is 68198 and the one with the lowest sales tax rate is 68007. The lessor must issue a Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6. Registration is required with each vehicle purchase to establish ownership and link the car to the purchaser.

The Douglas County sales tax rate is. Douglas County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Douglas County Nebraska. Please contact the Colorado Dept.

The minimum combined 2022 sales tax rate for Douglas County Nebraska is. The Nebraska state sales tax rate is currently. The Douglas County sales tax rate is.

150 - State Recreation Road Fund - this fee. Early payments for the current year taxes may be processed online starting December 1st with statements being mailed each year by Mid-December. State Sales Tax 184718 Motor Vehicle Tax 700 Local Sales Tax 50378 Omaha Wheel Tax 50 Motor Vehicle Fee 30 Passenger Registration 2050 Plate Fee 660 Total.

Additional fees collected and their distribution for every motor vehicle registration issued are. Original or copy of the front and back of the title or a copy of the bill of sale listing the date and time of vehicle sale notarized or signed under penalty of perjury. Our free online Nebraska sales tax calculator calculates exact sales tax by state county city or ZIP code.

161 rows ABRAMO JOSEPH C. The December 2020 total local sales tax rate was 4500. While many counties do levy a countywide.

Motor Vehicle Dealer Exercises the Buy-out. When a motor vehicle dealer exercises the buy-out option for the lessee the dealer may purchase the vehicle without sales tax if the vehicle is being purchased for resale. The most populous zip code in Douglas County Nebraska is 68104.

While many counties do levy a countywide. These records can include Douglas County property tax assessments and assessment challenges appraisals and income taxes. This is the total of state and county sales tax rates.

The Nebraska state sales tax rate is currently. Find Douglas County Tax Records. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

The bill of sale must be signed by both the buyer and seller. Money from this sales tax goes towards a whole host of state-funded projects and programs. 10 rows Douglas County Has No County-Level Sales Tax.

200 - Department of Motor Vehicles Cash Fund - this fee stays with DMV. Try our FREE income tax calculator. The fee for the temp tag is 703.

These buyers bid for an interest rate on the taxes owed and the right to collect. 3 rows Douglas County NE Sales Tax Rate. Has impacted many state nexus laws and sales tax collection requirements.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Douglas County NE at tax lien auctions or online distressed asset sales. 2915 NORTH 160TH STREET. The current total local sales tax rate in Douglas County NE is 5500.

Douglas County Nebraska Omaha Sheriff S Office Warrants Page 2 4statenews Middle Of The Country Middle Of The Road

Douglas Co Treasurer Dctreasurer Twitter

Douglas County Nebraska Growing Food Connections

Bellevue Police Will Receive 37 850 Pound Armored Vehicle For Rescues Local News Omaha Com

Douglas County Nebraska Growing Food Connections

Motor Vehicles Douglas County Treasurer

How The Nebraska Wheel Tax Works Woodhouse Nissan

Sales Tax On Cars And Vehicles In Nebraska

Nebraska Sales Tax Small Business Guide Truic

How Healthy Is Furnas County Nebraska Us News Healthiest Communities

Vehicle And Boat Registration Renewal Nebraska Dmv

Motor Vehicles Douglas County Treasurer

Motor Vehicles Douglas County Treasurer

Internal Auditor Douglas County Nebraska

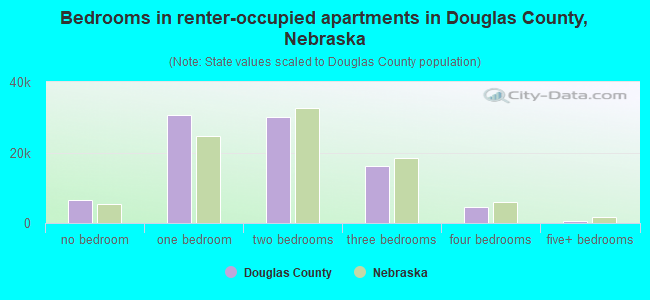

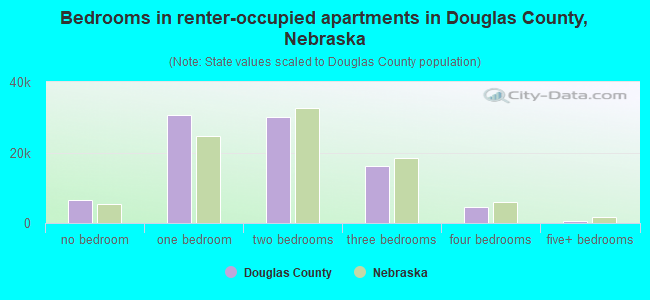

Douglas County Nebraska Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

/cloudfront-us-east-1.images.arcpublishing.com/gray/QJNBDO36B5K6JBWFVEM56S5IOU.jpg)

Douglas County Treasurer Reorganizing Service Locations

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Motor Vehicles Douglas County Treasurer

![]()

1 Douglas County Omaha Nebraska Department Of Motor Vehicles